You will also must apply for any specific permits or business licenses Which might be required for compliance, although it's clever to wait till your LLC's formation paperwork are approved.

An LLC shields business entrepreneurs from individual liability for business debts. This suggests you could drop The cash you've got invested while in the LLC, but business creditors are not able to appear after your own home, own lender accounts, together with other individual belongings. Corporations also supply this type of liability safety.

Tennessee Prospects: Attorney services in TN are supplied via a flat price legal service featuring from an independent legislation business and therefore are issue to the

Although the limited liability aspect is similar to that of a company, the availability of move-by taxation for the associates of the LLC is often a characteristic of a partnership as an alternative to an LLC.

Should the associates have not taken other methods to establish the business like a legal entity, like starting an working settlement and respecting other company formalities, anyone could “pierce the corporate veil” inside a lawsuit and go after the associates’ personalized belongings.

Liability insurance coverage for your business is additionally advisable In combination with the authorized protections particular assets may well obtain from an LLC business composition.

Editorial Observe: We earn a Fee from spouse inbound links on Forbes Advisor. Commissions tend not to have an affect on our editors' views or evaluations. Getty An LLC, or limited liability company, provides business operators the protections generally only afforded to businesses plus the simplicity generally only available to sole proprietorships.

The way in which you are taxed. C Company profits is taxed two times—the business pays taxes on its net profits, and then the shareholders also pay taxes on the gains they receive.

Filing to be a sole proprietorship. Allows for "go-by taxation," meaning business profits are directly noted within the operator's particular tax returns devoid of being taxed at the business stage.

Quite a few business charges may be composed off as business deductions, Hence lowering taxable income; these deductions are taken on the LLC or own return (depending on the taxation process picked, corporate or move-by means of).

Concerning the expanding availability of new systems and resources and also the growing benefits of tiny, agile business ideas, 2024 is shaping up to generally be on the list of best many years in latest background for smaller business house owners.

Drawbacks of an LLC Dependant upon you can look here state law, an LLC might need to be dissolved on the Dying or personal bankruptcy of the member. A company can exist in perpetuity.

Of course. In the situation of a company, profits are very first taxed at the company amount and then taxed a next time at the time All those profits are distributed to the individual shareholders. This double taxation is decried by a lot of businesses and traders.

We’ll check Should your company name is offered, and file the many required forms. Alongside one another, Enable’s make your business Formal.

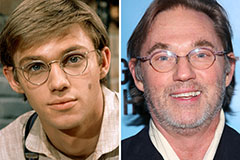

Taran Noah Smith Then & Now!

Taran Noah Smith Then & Now! Richard Thomas Then & Now!

Richard Thomas Then & Now! Batista Then & Now!

Batista Then & Now! Jane Carrey Then & Now!

Jane Carrey Then & Now! Peter Billingsley Then & Now!

Peter Billingsley Then & Now!